Legal Measures for Loan Recovery: Is it Absolute for Commercial Banks?

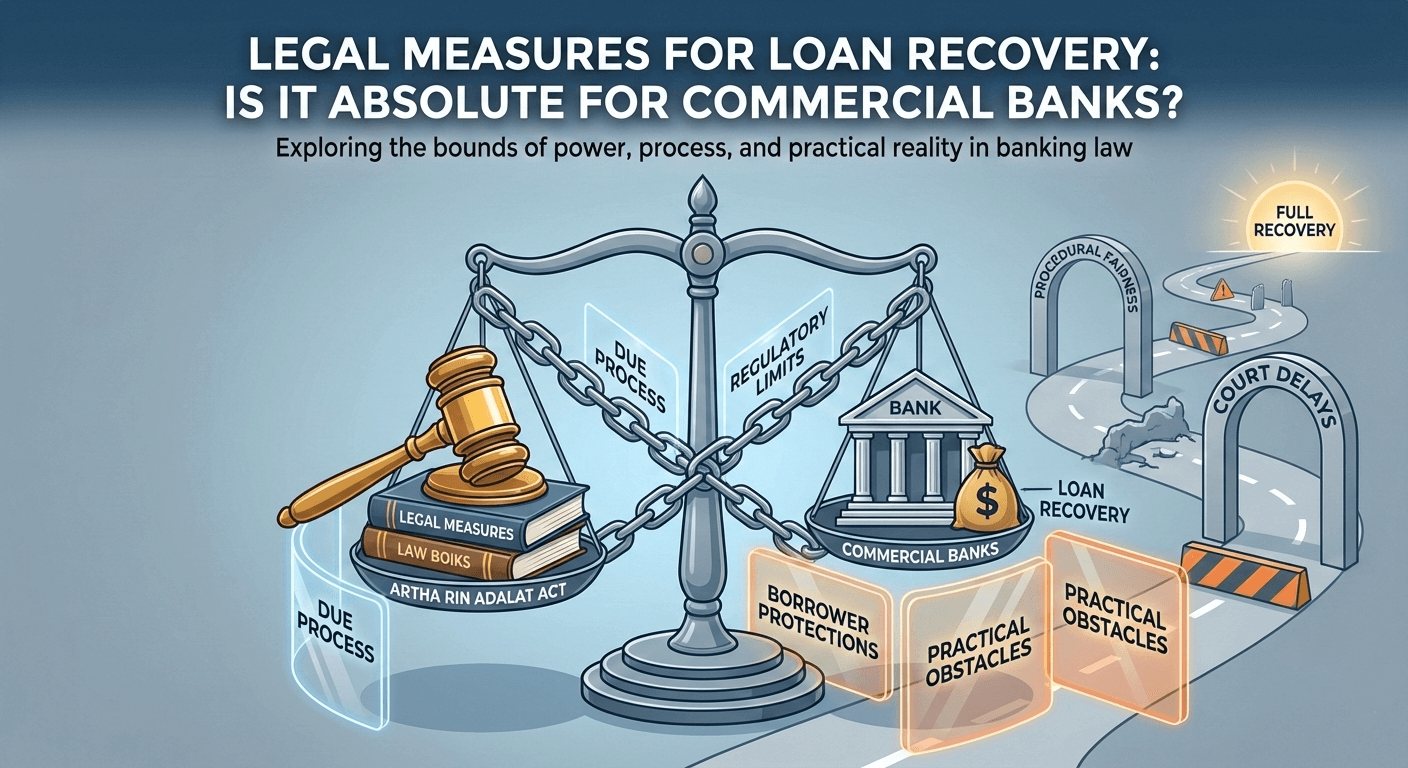

Legal Measures for Loan Recovery: Is It Absolute for Commercial Banks?

1. What Are Legal Measures for Loan Recovery?

Legal measures are formal, law-driven actions that commercial banks take to recover overdue or defaulted loans. These measures provide a legitimate and enforceable route to compel repayment when borrowers fail to meet their obligations.

- Artha Rin Adalat Act (ARA) cases

- Civil suits for recovery

- Criminal actions in cases of fraud or misappropriation

- Auction or sale of mortgaged property

- Certificate cases and execution suits

- Writ petitions in special circumstances

2. Are Legal Measures Absolute for Commercial Banks?

No, legal measures are not absolute. Although they are powerful tools, banks must operate within legal procedures, regulatory frameworks, and practical limitations.

A. Legal Measures Come After Exhausting Internal Remedies

Before initiating legal action, banks are expected to demonstrate that they have attempted internal recovery efforts such as:

- Loan rescheduling or restructuring

- Negotiation with the borrower

- Issuing reminder and demand notices

- Special Mention Account (SMA) monitoring

- Classified loan recovery initiatives

Failure to show these efforts may weaken the bank’s position before the court.

B. Law Favors Due Process, Not One-Sided Bank Power

The legal system ensures fairness and transparency by safeguarding:

- The borrower’s right to be heard

- Proper valuation of collateral

- A transparent auction process

- Reasonable interest and penalty charges

- Adequate notice periods

Banks cannot act arbitrarily or bypass legal safeguards.

C. Practical Obstacles to Enforcement

Even with strong legal backing, recovery is often delayed due to:

- Case backlogs in Artha Rin Adalat

- Appeals and stay orders from higher courts

- Difficulty in taking possession of collateral

- Political or external interference

- Weak or incomplete documentation

D. Regulatory Compliance Restricts Bank Actions

Commercial banks must comply with Bangladesh Bank regulations, including:

- CIB reporting requirements

- Loan classification and provisioning rules

- Schedule of Charges (SOC) compliance

- Loan rescheduling policies

- Interest application guidelines

Legal action cannot override regulatory obligations.

E. Borrower Protections Also Exist

Borrowers may defend themselves by citing:

- Force majeure events

- Genuine business losses

- Improper or defective documentation

- Incorrect interest calculation

- Illegal pressure or harassment

3. Conclusion

Legal measures are essential tools for loan recovery, but they are neither absolute nor guaranteed. Their success depends on multiple factors beyond the bank’s direct control.

- Strong documentation

- Early detection of default

- Effective relationship management

- Negotiation and restructuring efforts

- Proper collateral valuation

- Efficient legal follow-up

4. Short, Exam-Friendly Answer

No. Legal measures for loan recovery are not absolute for commercial banks. Although laws such as the Artha Rin Adalat Act provide strong legal authority, these powers are limited by due process, regulatory guidelines, borrower protections, court delays, and practical constraints. Therefore, legal action is necessary but not a guaranteed solution for loan recovery.