Nano Finance in Bangladesh: Present & Future

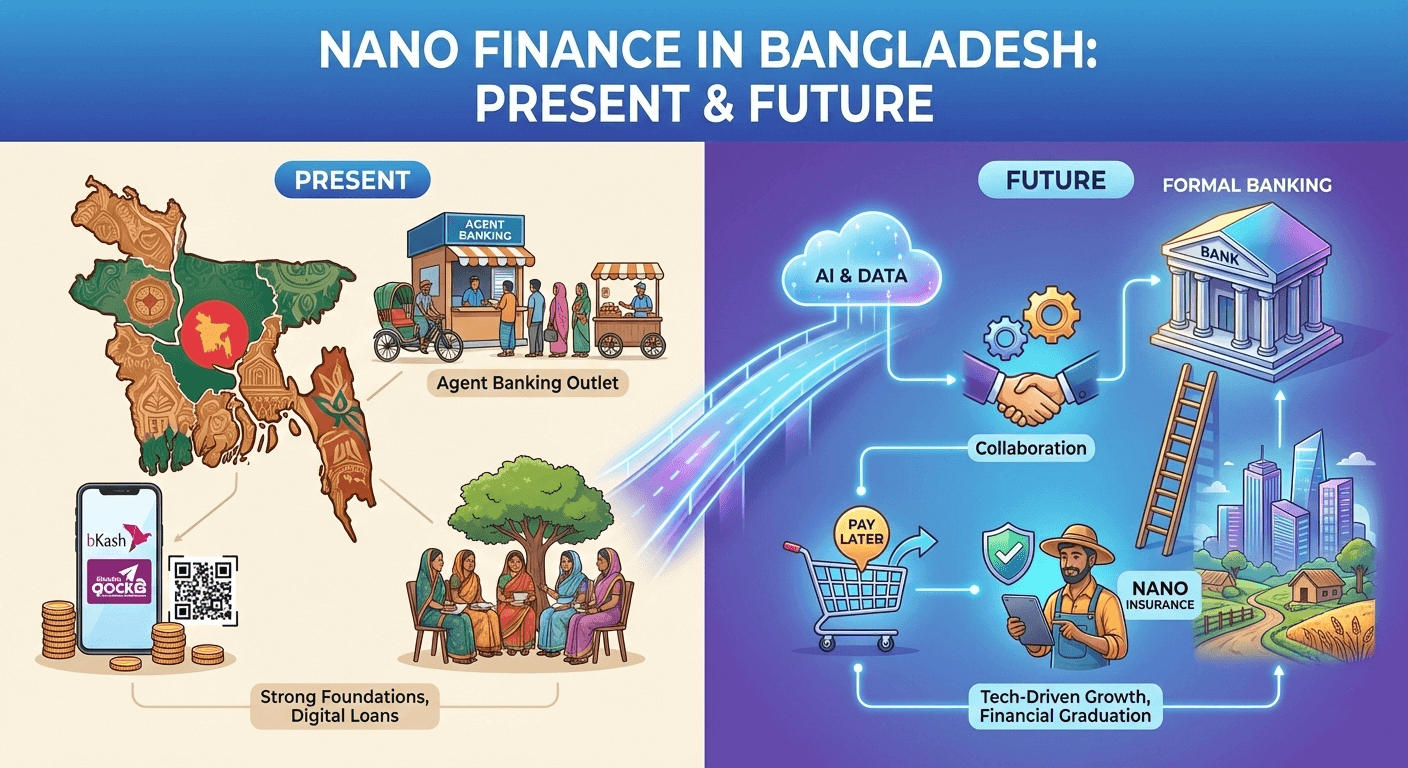

Nano Finance in Bangladesh: Present & Future

1. What Is Nano Finance?

Nano finance is not entirely new in Bangladesh. Mobile operators have long provided small credit facilities to prepaid customers by adjusting future refills, which is an early form of nano-level financial service.

Nano finance refers to very small-value financial services—such as loans, savings, payments, bills, fees, and insurance—designed for the ultra-poor, informal workers, daily earners, and micro-entrepreneurs whose needs fall below traditional microfinance thresholds.

It is typically faster, simpler, mostly digital, and highly transaction-based.

2. Present Scenario of Nano Finance in Bangladesh

(a) Strong Foundations

Bangladesh has a strong foundation for nano finance due to several enabling factors:

- A globally recognized microfinance sector (Grameen, BRAC, ASA)

- Widespread mobile financial services (bKash, Rocket, Nagad)

- High mobile phone penetration across low-income groups

- Expanding agent banking networks

Nano finance is emerging as the layer below microfinance, addressing short-term needs ranging from Tk. 500 to Tk. 10,000 for emergency cash and daily working capital.

(b) Present Forms of Nano Finance

Digital Nano Loans:

Short-term, small-ticket loans driven by transaction history and mobile usage data, offered by banks, MFS providers, and fintech companies.

Nano Savings Deposits:

Daily or weekly micro-deposits linked to mobile wallets, commonly used by rickshaw pullers, street vendors, and domestic workers.

Nano Payment Systems:

QR-based merchant payments, informal salary disbursements, and utility or government transfers.

NGO-Led Models:

NGOs combining trust-based lending with digital platforms to deliver ultra-small credit.

Regulatory Environment:

Bangladesh Bank supports financial inclusion through:

- Agent banking

- Digital KYC

- Interoperable payment systems

However, nano credit–specific regulation is still evolving.

3. Key Challenges Today

a. Credit Risk & Over-Indebtedness:

Easy access to small loans without a unified nano-borrower credit database increases default and recovery risks.

b. Consumer Protection:

Low financial literacy allows hidden charges and unfair pricing practices to persist.

c. Sustainability for Providers:

High operational cost per taka lent requires scale, automation, and digital efficiency.

d. Data & Privacy Issues:

Financial service providers must ensure ethical data use, security, and customer privacy.

4. Future of Nano Finance in Bangladesh

a. Technology-Driven Growth:

AI-based credit scoring using transaction and behavioral data will drive faster approvals, paperless processes, and real-time disbursement.

b. Bank–Fintech–MFS Collaboration:

Sustainable growth will depend on partnerships among:

- Banks → Capital & regulation

- MFS providers → Reach & data

- Fintechs → Innovation & analytics

- NGOs → Trust & last-mile access

c. Embedded Nano Finance:

Nano finance will integrate seamlessly into daily life through:

- Buy-now-pay-later for essentials

- Input loans for farmers via agri-apps

- Pay-as-you-earn models for gig workers

d. Nano Insurance & Social Protection:

Health, crop, and life nano-insurance with premiums as low as a few taka per week, linked to government safety-net programs.

e. Formal Credit Graduation Path:

Nano finance will act as a gateway: Nano → Micro → SME → Formal Banking.

5. What Is Needed for a Sustainable Future?

- Clear nano-credit guidelines

- National nano-borrower credit registry

- Strong consumer protection rules

- Grassroots financial literacy programs

- Responsible pricing and transparency

6. Conclusion

Nano finance in Bangladesh is no longer just a concept—it is rapidly becoming a necessity. In a country where millions depend on daily income, nano finance can:

- Reduce financial vulnerability

- Promote dignity

- Accelerate inclusive growth

If designed responsibly, nano finance could become the most impactful financial inclusion tool Bangladesh has witnessed since the rise of microcredit.